by Raj Laddha January 27, 2020, 12 PM

If you are confused about where to invest your hard earn money, having low risk or no risk. Then you are on the right page. In this, article we take a look at the best investment option in India you have.

Investing in money or capital in order to gain profitable returns, as interest, income, or appreciation in a value called Investment.

Before we take a look at the investment options. I want to ask you Why to Invest -? Because to increase your Financial health or to live a good lifestyle. As different people have different requirements. A good investment makes you Bottom to Top and a bad investment makes you Top to Bottom in just a minute.

So, here we are going to tell you the Best Investment Option in India that makes you grow your financial health.

1. Mutual Fund

Mutual Fund is one of the best options if you are planning for long term investment. Its return depends on the market rate of the funds which is managed by the professional money manager. Any individual who is not a minor can invest in mutual funds and its minimum investment of Rs 500 and there is no limit for maximum investment.

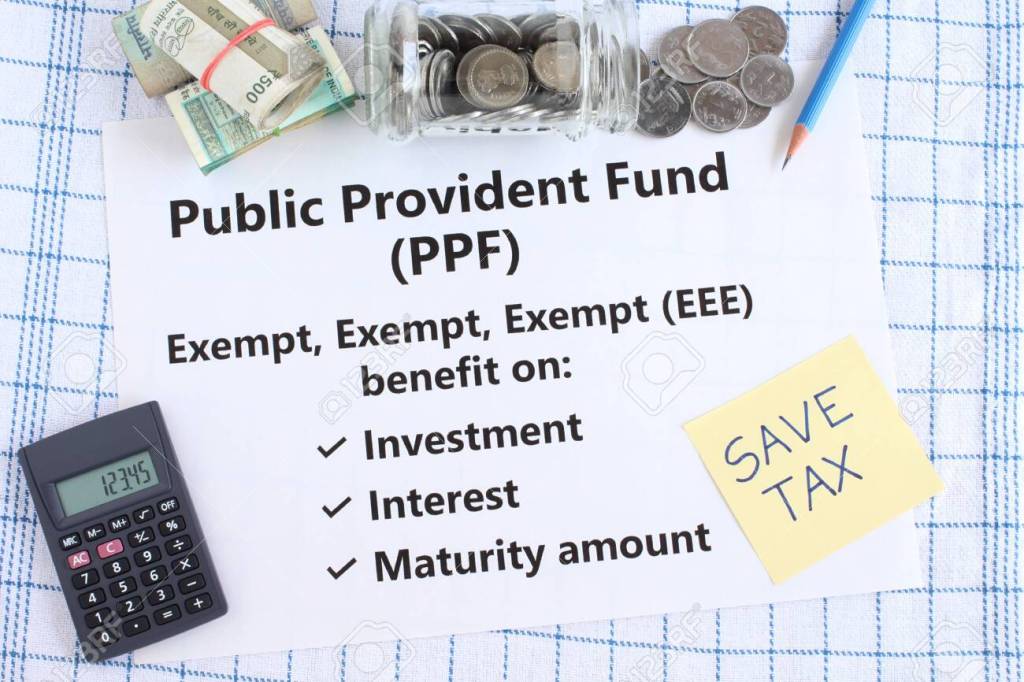

2. Public Provident Fund

Public Provident Fund (PPF) is a saving scheme. This account can be open in Bank or in a Post Office. PPF scheme is guaranteed by the Central Government. Principal and Interest are all exempt from tax at the time of withdrawal. Any citizen of India can open a PPF account. Since the investment is backed by the government, there is absolutely no risk involved. One more very important thing is that the account holder can also take a loan on this Account. The invested money can be locked in for a time period of 15 years but can be withdrawn after a time period of 6 years.

3. Real Estate Investment

Real Estate is the best option if you have an abundance of money in your hand. It offers higher returns over a longer period of time. In India, the Real Estate sector increases day by day because India is a developing country. When the investor or the owner of the property wishes liquidity as and there he can get. Real Estate has a very low risk, while the chances of increasing in price are very high.

4. Stock Market Investment

The Stock market is a platform where an individual can buy or sell shares of the company that is listed on the Stock Exchange. There are two types of stock exchange that is the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Investment in the stock market is done via stockbroker and electronic trading platforms. To Invest in the Stock market individual will have to open a Demat account in a bank where all the transaction has been done. Investment in the share market does not mean Intraday trading wherein it means to take shares a long term basis.

Note: Not to invest on the basis of tips.

5. Fixed Deposit

Fixed Deposit (FD) facility is provided by Banks and NBFC’s (Non -Banking Financial Company ). In Fixed Deposit lump sum amount of money has been deposited for a fixed period of time at a fixed rate of interest. The rate of interest is higher than the savings account interest. This interest rate is given on the basis of your time period. It does not require a separate account. Fixed Deposit is one of the safest and the secured way of Investment.